The book has 20 chapters and is written in a bottom-up style. Each chapter starts with a story and continues with an analysis and crystallises into a concept, e.g. appealing fictions, the power of compound interest, or room for error. Some chapters are interrelated and often repeated, e.g., how compound interest works or how to be wealthy.

In chapter 19 (pp. 207 - 210) he summarizes the recommendations from chapters 1 - 18. And in the last chapter 20, he shares his understanding of money, including his savings and general investment strategy.

In summary, the book is highly recommended for understanding human money mindset and behaviour before exploring various investment strategies, for example, "The Little Book That Still Beats the Market” by Joel Greenblatt.

After collecting all the key statements from the book, I classified them into 4 answered questions to reflect on my understanding:

1. What is money?

Money is a tool that gives us control over our time and allows us to live a lifestyle that few luxuries can compete with. Money should give us the freedom to have control over our lives, which means doing what we want, when we want, with whom we want, and for as long as we want.

We need to ask ourselves if by purchasing bigger and better things, we are giving up control of our time and life. Deep down we just want to be respected and admired, and possessions never make that true.

Getting money (being rich) is difficult, but keeping money (being wealthy) is even more challenging.

2. Should we be rich or wealthy to be happy?

|

Term |

Definition |

Value |

Method |

|

Rich |

1.

Getting Money 2.

Current

income 3.

Use the money

to buy stuff |

Utilizing stuff and showing the

possession (status) |

Having more income by taking

risks, being optimistic and going the extra mile |

|

Wealth |

1.

Keeping Money

2.

The income

we successfully put aside 3.

The

non-purchased bigger and more luxurious things |

Offering options, flexibility and

growth to buy one day. |

1.

Saving and

Investing (see question no. 4) 2.

be

reasonably frugal and be paranoid, fearing that what you have could be taken

away from you just as quickly |

By expecting less, we don't have to be rich (work harder or risk things we have or don't have) to be happy. Also expecting things to be bad (pessimistic), then being pleasantly surprised when they are better than expected. Also, we should set our standard and anything above that is a bonus.

One factor that might prevent us from being happy is social comparison because we don't feel enough when we compare ourselves to others or want to impress others.

3. Why do people invest in the stock market?

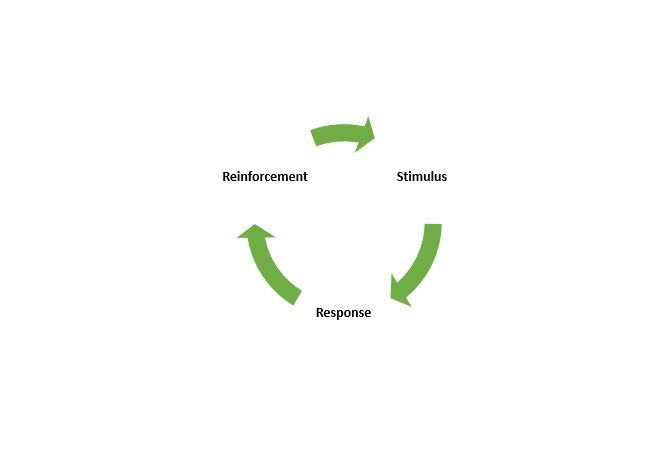

Investing is about a large group of people making imperfect decisions with limited information that makes even smart people nervous, greedy and paranoid. It is guided by people's behaviour, which sometimes doesn't make sense because it is based not only on the past, but also on greed, insecurity, or optimism. People's investing behaviour is also influenced by their culture, by different backgrounds, or by different experiences that make sense at the moment.

It is also hard to predict what people will do next if relying only on what they have done in the past. Moreover, experience tends to lead to overconfidence rather than predictability. The world is surprising and uncertain. We have no idea what might happen next.

Furthermore, we live in our subjective world and have our own perspectives and background. We see things as true only because we want them to be true (appealing fictions), and we form a complete narrative to fill in gaps. In the end, there is no one right answer that fits all, just the right answer suits us. Ultimately, there is no right answer that suits everyone, there is only the right answer for us.

4. How to save and invest in the stock market?

Everyone has their own game and their own goals, desires, hopes, worries, strategies and time horizons. Therefore, it is not right to copy the game of others or simply trust what others say. We need to trust in our own strategy and stick to it in the long run. We don't have to act according to rational points of view and sacrifice ourselves in saving and investing, but just be reasonable enough to achieve our goals.

We don't have to find reasons to save, we can just save for the sake of saving. A high savings rate can be achieved with modesty, which means we should aim for a high income but have less ego, fewer expectations, fewer desires, and worry less about what others think about us. Saving gives us more freedom, flexibility and control over our lives.

The best investor is the one who has a longer time horizon (the power of compound interest and consistency). The most important thing is not to go for a one-time big return, but to go for a pretty good return that we can stick to and repeat over a long period of time. We can be wrong half the time and still make a fortune because no one makes a good decision all the time, but the most important thing is to never give up.

Consistency is important, but it is even more important to be flexible. Life changes, and so do we. Therefore, we must be flexible and accept the changes in our life without being radical, because those who are radical will regret it in the future. Also, we should not base our decision on past efforts that cannot be repaid (sunk costs).

Sometimes it's not about bad decisions or laziness, intelligence or hard work. It's all about luck and risk. We need to set the risk as high as we can still invest in the market until the situation is in our favour. Hang in there long enough for the compound interest effect to work wonders, especially in times of chaos and devastation. In other words, only invest enough so that we can sleep at night.

Also, the author stresses the importance of room for error, i.e., having a plan in place that embraces uncertainty and survives reality (You plan, god laughs; German: Man denkt, Gott lenkt). Kevin Lewis said, "We must make sure that we have enough money to withstand any swings of bad luck."

Finally, successful investing comes at a price, namely (not dollars or euros) its volatility, fear, doubt, uncertainty and regret. Since we usually get what we pay for, just find the price of it and pay it.

Resource: Housel, Morgan. 2020. The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness. Hampshire, Great Britain: Harriman House.

(Published on 08 March 2022)